“Yet the Big Mac index has become a global standard, included in several economic textbooks and the subject of at least 20 academic studies. “Burgernomics was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible,” The Economist reports, winking.

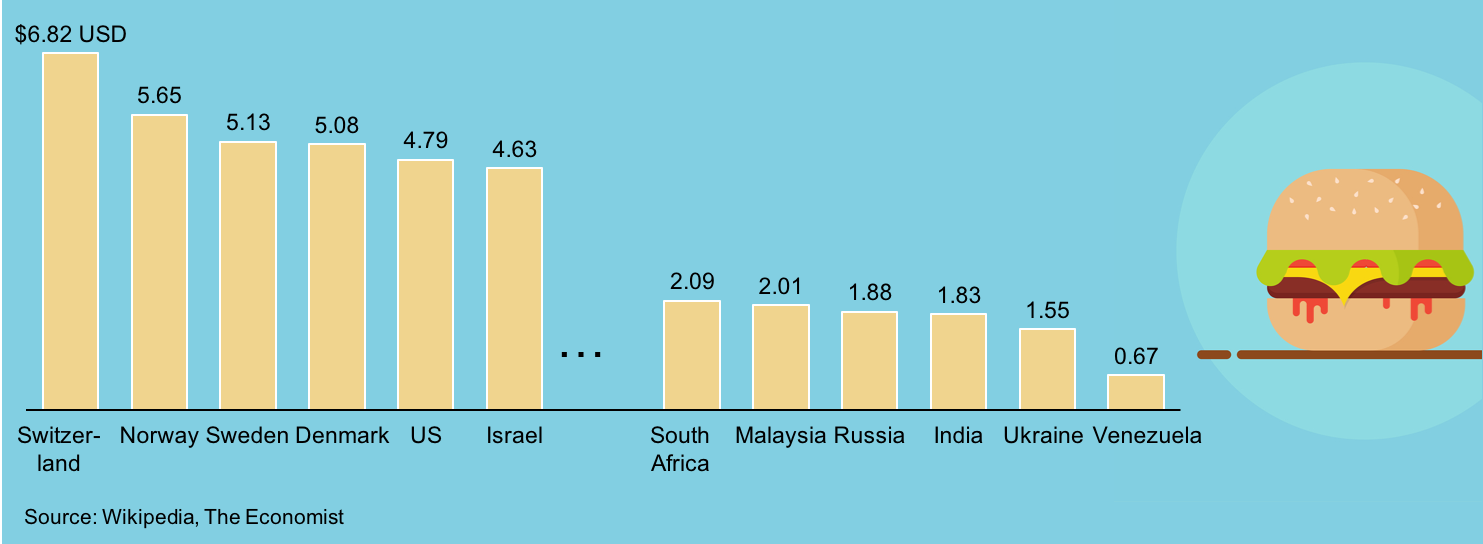

If you’re hungry for more, The Economist added a few more variables to create an adjusted index that might better reflect real-world economies. Because that’s more than a Big Mac costs in the United States, the Index would say that the Swiss franc is overvalued compared to the dollar-in this case, by 27.2 percent. This currency was undervalued by 45 percent if the Big Mac Index is to be believed.Īt the same time, the Swiss paid the equivalent of about $6.74 for a Big Mac. The Big Mac Index, then, tells us that the Chinese yuan was worth more than the exchange rates gave it credit for. At that date’s exchange rate, Chinese citizens were only paying the equivalent of $2.92 for their Big Macs. dollars for a Big Mac was $5.30, reports The Economist. The Big Mac Index at WorkĮconomics can be complicated, and the Big Mac Index is a way to cut through the confusion. The Index worked so well that professors now teach it to economics undergraduates. The Big Mac Index started as a lighthearted way to demonstrate the theory of purchasing power parity, but it took on a life of its own. So, if a pound of rice is “worth” $2 in the United States, market forces will eventually bring costs to around the same amount in every currency.īut what fun is rice? The Economist substituted the Big Mac for the “basket of goods” in traditional PPP discussions, and they continue to publish the figures. This theory holds that pricing for a single “basket of goods” will eventually level out from one nation to another. To explore these questions, the writers leaned on a macroeconomic theory called purchasing power parity, or PPP. The goal was to teach readers to ask and answer questions about exchange rates: How accurate are they? Is one country’s currency undervalued or overvalued? How can we tell? In 1986, venerable weekly The Economist invented a new way to understand exchange rates between one country’s currency and the next. Economists use a metric called the Big Mac Index to illustrate a powerful force in the world economy. What does a 540-calorie fast-food burger have to teach us about macroeconomics?Ī whole lot, it turns out.

0 kommentar(er)

0 kommentar(er)